News & Blogs

How BESS technology helps power the grid

Utility-scale batteries primarily provide energy to the grid in two ways: ancillary services and energy arbitrage.

Ancillary services ensure the grid is stable by providing additional dispatchable capacity when needed. Despite the challenges facing on the grid, batteries are uniquely suited to these tasks thanks to their controllability, fast response times and ability to provide short durations of electricity.

Ancillary services are a proactive set of tools that can be quickly deployed to help the grid meet demand and maintain stability.

Comparing ancillary services with an insurance policy for the grid: “You want to have them, but you don’t actually want to ever use them because if you’re using them, that means you’re in a tight position.”

As an ancillary service, short-duration batteries can be utilized briefly, sometimes for only minutes or seconds, such as when a transmission line fails, or a power station trips offline.

In these instances, batteries can be deployed rapidly to reinforce grid operations.

Energy arbitrage, on the other hand, refers to buying electricity when prices are low and selling electricity when prices are high, with the goal of profiting from price differentials — not unlike the logic behind stock trading. This strategy is one that is often employed by battery operators seeking to maximize profits from price fluctuations.

A closely linked strategy known as load shifting involves moving consumption from high-demand periods to low-demand periods .

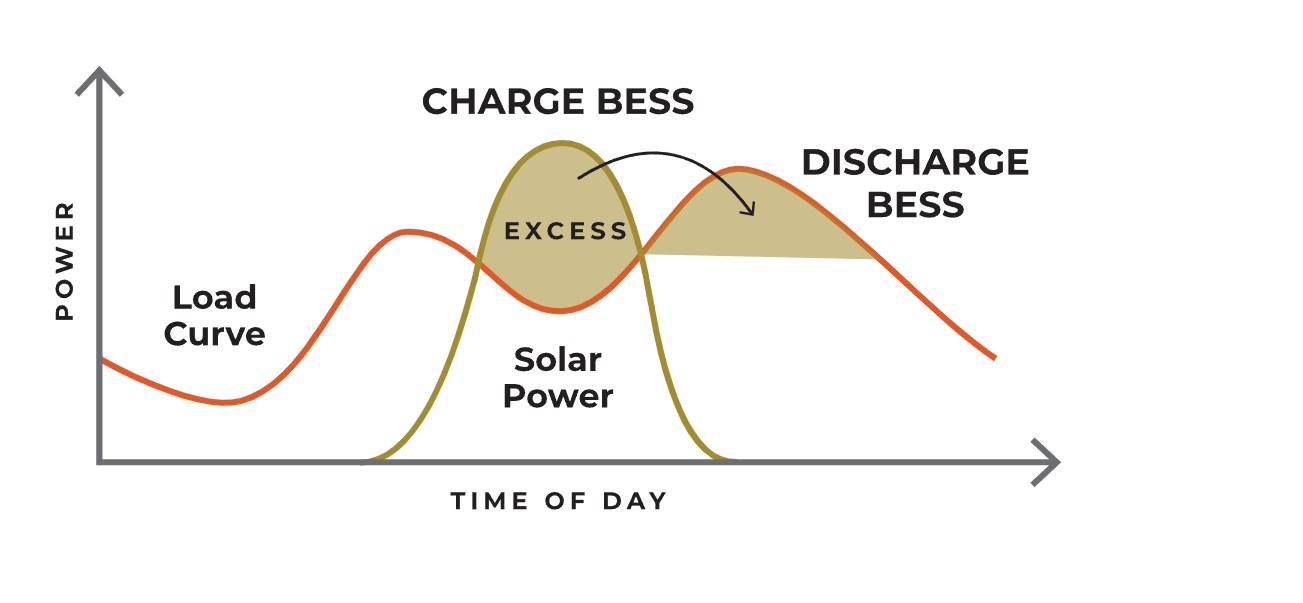

With BESS, these strategies can work in tandem. For example, a battery can charge at midday when solar generation is high and electricity prices are low, then discharge that stored energy in the evening when solar output declines, demand increases and prices rise. In this scenario, batteries are engaged in energy arbitrage and peak-load shifting. The strategy of peak-load shifting not only smooths out peak demand periods and lowers grid strain, it also reduces energy costs.

PEAK LOAD SHIFTING